Mr. Kelimbetov was appointed as the Governor of the Astana International Financial Centre on 24 December 2015. He heads the AIFC and is a member of the AIFC Management Council. Mr. Kelimbetov has previously served in the public administration of Kazakhstan in various positions, including as the Governor of the National Bank of Kazakhstan, the Deputy Prime Minister of Kazakhstan, the Minister of Economic Development and Trade of Kazakhstan, etc. Mr. Kelimbetov is a graduate of the Lomonosov Moscow State University, the National Higher School of Public Administration under the President of Kazakhstan, and Georgetown University (USA).

As the countries of Central Asia increase their cooperation, with several high-level summits having taken place over the past few years, what are the more specific goals and expectations for the enhancement of economic cooperation for Kazakhstan? How can regional cooperation develop outside of, or in addition to, the trade frameworks that are already in place, such as Eurasian Economic Union or WTO? What new economic and trade linkages have been developing between the countries of Central Asia since the inception of the new regional cooperation spirit?

Economic relations among the countries of Central Asia have been developing quite robustly in recent years. For example, Kazakhstan’s trade with its neighbors has increased by 50% just in the last five years. And, most importantly, there is a growing number of joint projects involving Central Asian states geared towards greater connectivity and more active trade and investment among them. According to the World Bank estimates, the development of transport connectivity in the region may add as much as 15% to the combined GDP of Central Asian countries.

Let me mention just a few initiatives involving Kazakhstan. Kazakhstan and Uzbekistan have constructed the Central Asia International Trade and Economic Cooperation Center on the border between the two countries. A high-speed railroad Turkestan–Shymkent–Tashkent is in the works. Beyenu–Akzhigit highway has connected Uzbekistan with our ports, Kuryk and Aktau, on the Caspian Sea. Another highway, Turkmenbashi–Garabogaz, will improve the automotive connection between Kazakhstan and Turkmenistan.

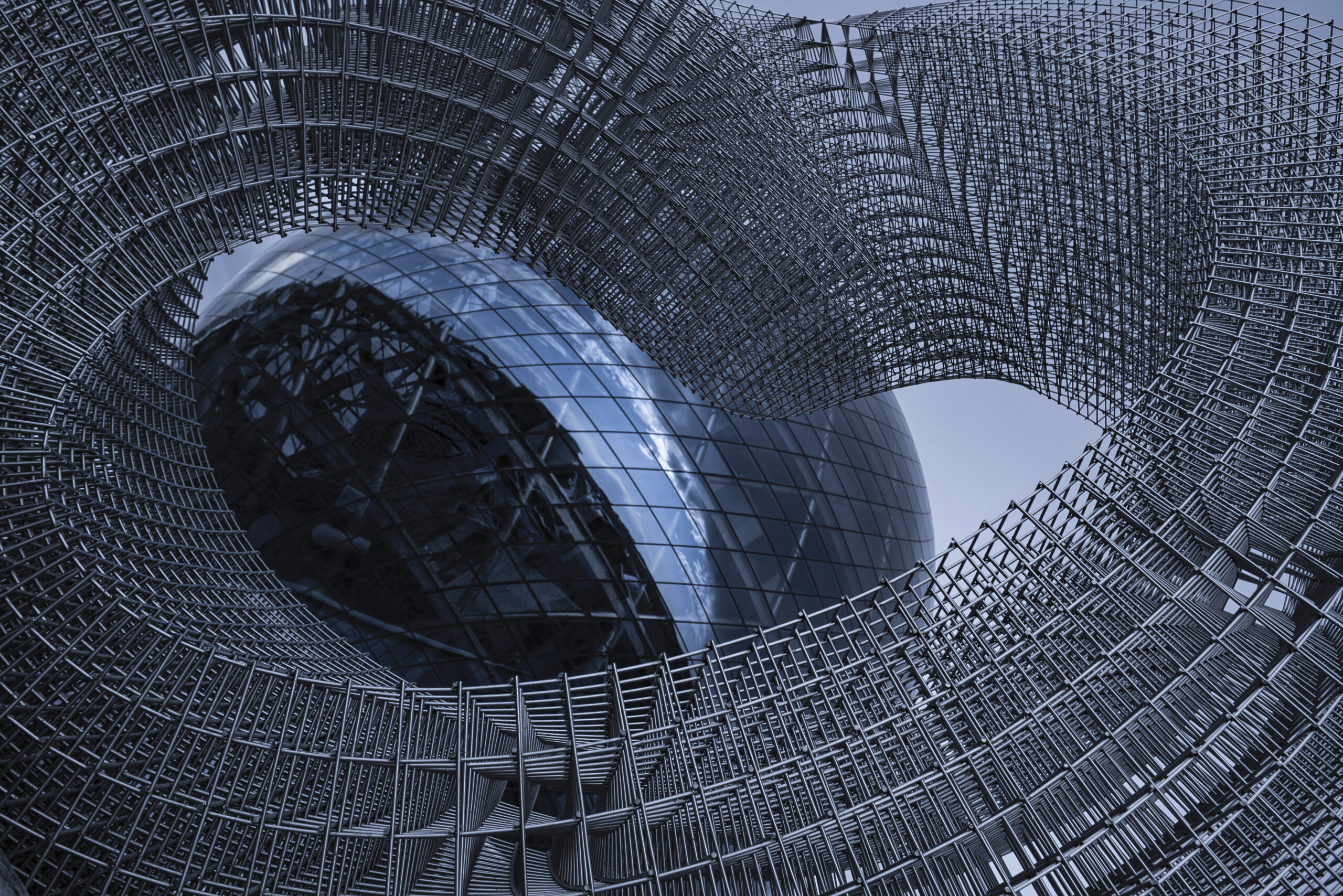

And the Astana International Financial Centre (AIFC) is set to play a role well beyond Kazakhstan’s borders, to become a gateway for international investors to the whole region. Thanks to the English common law regime, independent Court and Arbitration, and best international management practices introduced at AIFC, we offer familiarity and comfort for international investors. We open Central Eurasia as an investment destination for global business and contribute to the region’s economy and integration in the global supply chains.

Turning to another massive economic initiative, the Belt and Road Initiative, some researchers state that China is already localizing some of its operations in Central Asia that may result in higher value-added production. Chinese companies invest in local skills and talents and increase local purchases. How can the government of Kazakhstan complement this effort? Are there any government programs that aim at the creation of new skills adapted to the BRI needs? On the other hand, if the BRI is emphasizing transit opportunities only with insufficient localization how can the government of Kazakhstan turn it into bigger advantages for its broad economy?

It is important to remember that the BRI is a living and growing initiative and is bound to undergo changes over time, including the level of localization or demand for specific skills. We try to focus on the more permanent elements of this initiative relevant to Kazakhstan. Most importantly, Kazakhstan enjoys a uniquely advantageous geographic position. More than two-thirds of land transit between China and Western Europe takes place through our territory. And in just ten years, the volume of this transit has increased more than nine-fold.

Furthermore, one of the long-term consequences of COVID-related disruptions of the global supply chains is a new—or added—focus on the resilience of these supply chains. Thus, we expect continued growth in the volume of land shipments, including through our territory, in the years to come. We have long recognized our natural advantages. Even as early as the 1990s, when improving transport connectivity between Kazakhstan’s regions, we viewed this as a foundation for future transcontinental transport corridors. To give one specific example—to date, Kazakhstan has invested more than $30 bn in roads, dry ports, and distribution centers. The transport connectivity has been, and will remain, the focus of Kazakhstan’s efforts.

And I think the element of the BRI which requires the most significant support in terms of human capital development in Kazakhstan is the Digital Silk Road. It covers a wide range of initiatives, including better digital connectivity, greater use of online technologies in the business and public sector, and expansion of the Internet of Things, to name just a few. These areas require both hard and soft skills. Therefore, Kazakhstan is very much focused on supporting such development. The national program, Digital Kazakhstan, launched in 2018, provides, among other things, funding and support for a variety of educational and training programs.

Kazakhstan has managed to get back on the road to economic recovery, and economic growth in 2021 is expected at 3.7% as per IMF projections. Traditionally, the Kazakh economy would fluctuate with oil price dynamics and the Russian economy. Do you think in the past years this correlation has weakened in any way? How does Kazakhstan ensure more independence in economic policy amid two great partners, such as Russia and China?

Diversification is a key strategic priority for Kazakhstan. Compared to other oil-rich countries, we are already doing quite well: more than 37% of our revenues are from non-oil exports. But, in the short term, commodities will continue to serve as an essential source of revenues and growth for our economy, and the rapid recovery of commodities prices, including oil, is an added impetus to our post-COVID economic recovery.

We also understand that given the collective efforts of the global community to reduce carbon footprints, the role of oil and gas will change. However, it will remain significant due to the wide use of oil products in many industries: from special equipment production to pharmaceutics.

Having said that, we will continue on our path to diversify our economy and are focusing on several industries as priorities. First, Kazakhstan has natural advantages and excellent prospects in sectors like agriculture, foodstuffs, and tourism, and there are specific strategies in place to develop those.

We are closely looking at major global trends related to the Fourth Industrial Revolution—including artificial intelligence and digitalization—that will make Kazakhstan part of global value-added chains. And this is where the AIFC’s role will continue to expand. In particular, we are focusing on supporting startups on our Tech Hub platform.

Our proximity to large economies like China and Russia obviously has a significant impact on Kazakhstan’s trade and economy. Kazakhstan actively participates in both the Eurasian Economic Union and the Belt and Road Initiative. However, we maintain our sovereign and multi-vector foreign policy, including our economic, trade, and investment relations, in line with our national interests. Given this strategy, we consider our proximity to China and Russia as an advantage that allows us to leverage access to both of these vast markets for regional and Western investors, and position ourselves as an indispensable transit hub for the whole region. And in this context, the AIFC has enormous potential to serve as a financial facilitator of business transactions involving companies from both countries.

The government of Kazakhstan has an efficient system in place to support the economy via various state initiatives (Nurly Jol, Nurly Jer, credit lines to SMEs through commercial banks). President Tokayev has suggested recently several national projects. How do you assess the state’s financial capacity to sustain that support? What effect do these stimuli have on entrepreneurs, banks, and the overall economy?

Indeed, this is a massive initiative—ten national projects to achieve ten national priorities are estimated at $115 bln, with two-thirds to be funded from private sources. The priorities target improved institutions, a more robust economy, and growth of wealth and well-being; they cover healthcare, education, digitalization and innovative economy, entrepreneurship, the agricultural sector, as well as regional development and the green economy. I think this is a very positive approach, allowing Kazakhstan to address priority issues and key industries in a robust and cohesive manner. Another key objective of the national projects is to improve resilience and support the diversification of the economy. The state’s role is to stimulate entrepreneurial activity, ensure a fair playing field for business, and support the development of human capital—and the national projects address all these objectives.

The AIFC has been functioning since 2018. Could you tell us a little bit about the progress it has made? What new principal companies have come to the AIFC, what do they find special in this platform? The agriculture and commodity trades are a big part of regional economic interaction in Central Asia, any plans to develop commodity exchanges in addition to the AIFC?

In just three years since its launch, the AIFC has attracted more than 1,000 participants from many countries around the world. We have both major global companies and startups as our participants in sectors ranging from mining to agriculture, professional business services, fintech, Islamic finance, and various blockchain applications, to name just a few. For each one of them, there are specific features of our regime that have attracted them in particular. But based on our conversations with them, the most important consideration is the sense of comfort and familiarity provided by the English common law regime, the independent Authority, Court and Arbitration Centre, and international-standard management practices, not to mention the tax privileges and other incentives. It is no surprise that the AIFC has already contributed to bringing in investments to Kazakhstan in excess of $5.5 bn.

Countries around the world develop sweeping new visions for post-pandemic economic growth focusing on the green economy, health, education, digital sector, etc. What are Kazakhstan’s plans in this regard?

We are about to enter a very different world once the pandemic is over. But many of the elements you mention have long been on Kazakhstan’s and the AIFC’s agendas. I already mentioned our efforts to develop professional education and support for fintech startups—these are key pillars of our strategy and support to the business community.

And the green economy is a universal issue that is of great concern to public officials and businesses alike. The environmental agenda is making a significant impact on the regulatory regime of our key trading partners, including the EU, which accounts for more than 50% of Kazakhstan’s total trade turnover. In 2013, Kazakhstan adopted the concept of transitioning to the green economy. In 2015, our country joined the Paris Agreement, and, in 2020, we announced our goal to reach carbon neutrality by 2060.

At the AIFC, we have created the Green Finance Centre, designed to address this issue from the financial point of view. This Centre addresses various environmental aspects of investments, including ESG reporting. We are becoming one of the drivers of the decarbonization process in Kazakhstan by issuing green bonds and support for environmentally sound investment projects in our country and the region as a whole. In August 2020, the Damu Entrepreneurship Fund, as part of an agreement with the UNDP to promote renewable energy investments, issued green coupon bonds on the Astana International Exchange (AIX) of 200 million tenge, due to mature in 36 months and with a coupon rate of 11.75%. This was the first security listing that met with exchange green bond principles and the first listing of green bonds in Kazakhstan. Most importantly, it set the path for new listings and the growth of the green financial market in Kazakhstan and at the AIFC in particular.