By Zhandos Ybrayev

NAC Analytica, Nazarbayev University

Zhandos Ybrayev is a Senior Researcher at NAC Analytica – Nazarbayev University with a focus on macroeconomic theory, monetary policy and development economics. He holds a PhD degree in Economics from the University of Massachusetts – Amherst. Primarily, in his research, Zhandos explores the interactions of monetary policy with labor markets, financial markets, and economic growth. His areas of expertise also include urban development and political economy analysis of Central Asian region.

The coronavirus outbreak and subsequent policies of lockdowns both in cities and on interregional scales has brought about immense, and simultaneous, public health, economic, and social crises in Kazakhstan. This is particularly due to the COVID-19 induced negative supply shock, quarantine measures that have affected the service sector disproportionately, thus driving economic activity in certain industries down to zero. Due to the potentially long-term sluggish structural adjustment of the economy, a large proportion of workers employed in those industries (both formal and informal) are facing the grim perspective of a prolonged period of lost-incomes and possible mass layoffs with lasting depressing effects on aggregate demand, which can further depress the economy. Consequently, Kazakhstan will likely experience the adverse impact of the lockdown from medium to long-term perspectives with a high chance of prolonged scenarios of recovery. Thus, it is also vital to analyze pointed monetary and fiscal policy responses, which will help to mitigate long-term economic losses and save human lives.

Governments and central banks in advanced economies were quick to adopt aggressive and unprecedented policy interventions. Various lockdown procedures, with most businesses ordered to shut down and workers to remain at homes, were emerging as a general first response to the pandemic. In addition, fiscal authorities executed rapid cash transfers to people in order to compensate for lost incomes and provide secure funds for the most vulnerable social groups. Following the widespread quarantine measures in many Western countries, unemployment claims have skyrocketed, reaching historically high levels in a very short period of time. Developing and emerging countries have also adopted similar measures of strict general lockdowns. (Alon, et al. 2020) However, it soon became evident that these same policy responses could not be reproduced in less-developed economies. In particular, these governments lack the fiscal capacity for delivering transfers to the population for a prolonged period of time, as workers are characterized with a very high propensity to consume out of their current income, making lengthy lockdown policies economically impractical. In addition, large size of informal sectors significantly limits the taxable base (Alfaro, Becerra and Eslava, 2020). Thus, there are growing concerns that the policy responses in the developing world should be different from the ones realizing in advanced economies.

In this paper we investigate the following question: what is the economic impact of the COVID-19 crisis in Kazakhstan? To answer this question we provide several aggregate macroeconomic outcomes, which will help us to analyze the degree and magnitude of the market disruptions to the economy. Thus, in this paper, we consider the latest available statistical evidence on several core issues, such as unemployment numbers, headline inflation, and retail trade dynamics numbers, which is one of the largest portions of consumer spending and main component of aggregate demand and national output. These short-run effects also are likely to be a lower bound on the adverse economic impact of the COVID-19 lockdown, as repetitive quarantine measures will probably cause more business failures and further deterioration of the country’s economic outlook. Nevertheless, adequate and timely assessment of the damage instigated by the coronavirus-originated supply and demand shocks is also central to design effective policy interventions.

This paper is organized as follows: the next section briefly reviews the available literature on the economic impact of the COVID-19 crisis both in advanced and emerging economies. Section Three provides the latest statistics on coronavirus infections, death rates, and age distribution of the population in Kazakhstan. Section Four characterizes the macroeconomic consequences of the coronavirus-induced lockdowns on unemployment, inflation, and retail trade. Section Five presents policy responses undertaken by the government and possible scenarios for cooperation with key international organizations for greater relief packages. The last section concludes.

Related Literature

Early papers on the dual economic-epidemiological impact of novel coronavirus provided an introduction to the SIR model (susceptible-infectious-recovered) and its implication for COVID-19 in the U.S. (Atkeson 2020) (Stock 2020). A number of following studies started combining the economic trade-offs and conducting the optimal policy analysis within the SIR framework (Rowthorn and Toxvaerd 2020) (Eichenbaum, Rebelo and Trabandt 2020) (Alvarez, Argente and Lippi 2020). Additionally, another study (Acemoglu, et al. 2020) develops a multi-group version of the SIR population-based model and focuses on identifying the benefits of targeted policies that lockdown various groups differently. In particular, for the baseline parameter values for the COVID-19 pandemic applied to the U.S., the authors found that the optimal strategies differentially targeted risk/age groups considerably outperform uniform lockdowns and the largest gains realized through stricter lockdown measures on the oldest group.

In addition, (Chetty, et al. 2020) another study reviews the U.S. private sector’s daily data on consumer spending, business revenues, employment rates, and other key microeconomic parameters by county, industry, and income group. They found that high-income individuals reduced spending sharply, particularly in areas with a high-rate of COVID-19 infections and with businesses that require physical interaction. This reduction of spending significantly decreased the revenues of small firms, and particularly those located in affluent ZIP codes. Indeed, businesses that offer fewer in person services, such as financial and professional services firms, experienced smaller losses. Hence, the most efficient path to a full recovery for advanced economies in the long run is understood as a rebuilding of the consumer confidence by addressing the virus itself, rather than stimulating aggregate demand (which is already restrained due to health concerns) or providing liquidity to firms (Allen, et al. 2020) (Romer 2020).

Relative to the experience of emerging market economies, it is important to consider the informality of the labor markets and employment, which accounts for over half of the labor force. At the same time, workers in less developed regions are increasingly concentrated in occupations requiring physical contact with the customer, and thus, make them less fit for telework. Thus, employees in EMEs are more exposed to immediate income losses due to blanket lockdown policies and social distancing practices, especially those occupied in non-essential services (hotels, cinemas, theaters, gyms, apparel). Moreover, the aggregate socio-economic impact might be larger, because workers often lack formal employment protection, which is exacerbated by the already weak and/or inefficient mechanisms of state-organized social safety nets. At the same time, informal sectors recover from lockdowns more rapidly than those located in formal industries, and they also face minimal organizational capital and hiring and firing costs. Formal firms and workers, albeit more resistant at the initial states, may suffer even more during the prolonged economic deterioration, because once shattered, organizational capital is highly valuable and difficult to rebuild.

(Alfaro, Becerra and Eslava, 2020) Another study uses the case of Colombia as a typical example of a developing country with a very high informality and high concentration of workers in self-employment and small- and micro-businesses. The authors found that as many as 56% of jobs and 43% of the value added output (aggregate output) as the lockdown measures were imposed. However, as informal sectors rebound rather quickly during recovery, the employment-at-risk decreases to 20% of the baseline, which are entirely in the formal sector jobs. Thus, the authors suggest that restarting the informal sector is better addressed through direct cash transfers than through job protection policies. Also, they conjecture that the strategies of lengthy strict lockdowns are not feasible in developing countries. To reduce the need for repetitive lockdowns and given the narrow fiscal capacity in developing economies, the most successful health strategies will require extensive and wide-spread policies on testing, tracing, and timely isolation of local outbreaks.

There is broader literature exploring the difference in firm size, distribution across countries, and their influence on aggregate economic activity. Previous research has found that small firms mostly dominate the distribution of firms within manufacturing, compared to advanced economies (Tybout 2000) (Hsieh and Klenow, 2009) (Poschke 2018). The possible causes of such developments can be found in the average lower growth cycle of manufacturing in developing countries and poorer performances of super star firms (Hsieh and Klenow, 2014) (Eslava, Haltiwanger and Pinzón 2019). Moreover, there is a disproportionately large concentration of small-size employment in developing countries that has been documented not only in manufacturing, but also in service sectors (Alfaro, Charlton and Kanczuk, 2009). Studies have shown that the domination of small-size firms and small firm employment in developing countries is associated with the market distortions of the optimal allocation of resources (Hsieh and Klenow, 2009), (Bento and Diego 2020). Recent papers have focused on labor market outcomes during the COVID-19 pandemic (Cajner , et al. 2020) (Coibion, Gorodnichenko and Weber 2020) (Naidoo 2020), and those specifically discuss the perspective of small firms (Humphries, Neilson and Ulyssea 2020) (Bartik, et al. 2020). Therefore, within the economic consequences of the COVID-19 pandemic, one of the contributions of this paper is to describe the differential exposure within the distribution of Kazakhstan’s firms to government-imposed lockdowns that slow down the spread of the coronavirus, which also should be the base for well-designed policy interventions.

COVID-19 in Kazakhstan

The first coronavirus case was recorded in Almaty on 13 March, 2020. It involved two Kazakh citizens on their return back from Germany (Coronavirus2020.kz). On 15 March, President Tokayev declared a state of emergency that began at 8am on 16 March to 7am on 15 April, 2020. In addition, on 17 March, Tokayev ordered the cancellation of Nauryz (public holiday) and military parades in honor of the 75th anniversary of the victory day in the Second World War. Beginning 19 March, 2020, the cities of Nur-Sultan and Almaty were fenced by roadblocks and sanitary posts, which restricted the entry and exit of individuals to the cities and also imposed a blanket lockdown that started. On 13 April, 2020 the state of emergency was prolonged until 11 May, 2020. This date effectively marks the strict lockdown period and “shelter-in-place” policy due to the coronavirus outbreak in Kazakhstan.

As of 1 July, 2020, the total number of cases in Kazakhstan reached 41,065 patients, with about 1,500 new cases daily on average during the month of June 2020. As seen in Figure 1, the log-transformed graph of total cases in Kazakhstan demonstrates a positively sloped dynamics throughout the entire period starting with the first case recorded on 13 March, 2020 in Almaty city. Two referenced lines indicate the state of emergency and blanket lockdown period. As we can conjecture from the statistics, in terms of mitigating the spread of the disease, the lockdown policy was effective as the curve was steadily converging towards plateau by the end of the lockdown term. However, the eventual lift of the state of emergency policy produced another upward-sloped tendency in total cases, which did not allow for a sufficient enough suppression of the coronavirus infection and contributed for rapid uncontrolled spread later. The uptick at the end of the graph displays a moment, when the Ministry of Health Case of Kazakhstan started to combine asymptomatic and symptomatic cases together, thus likely underestimating the real total number of cases in the country.

Figure 1: Coronavirus infections (as of 1 July, 2020)

Source: coronavirus2020.kz

Next, in Table 1, we can highlight several important points about the distribution of deaths in Kazakhstan. First of all, the death rate is disproportionately high among the elderly. The share of people aged 50 and above constitute for about 91 percent of all recorded deaths due to COVID-19 in Kazakhstan (as of July 1, 2020). Within this group, the percentage of those aged 60 or older accounts for about 70 percent, with 68 percent of those patients male and 78 percent female patients. The number of lethal cases falls sharply with the next group of population aged 49-40. The death rate among this age cohort (49-40) accounts for about 8 percent of total deaths, whereas the group 39-30 barely comprises 1 percent. The youngest group of (0-29) does not have a single coronavirus-related death officially recorded. Such a stark difference in magnitudes also suggests analyzing the benefits of targeted lockdown policies, instead of strict quarantine measures for all.

Table 1. Death by age group*

| Age | Male | Female | Total | Share of Males | Share of Females | Total share by age |

| 60+ | 68 | 57 | 125 | 62 % | 78% | 68 % |

| 59-50 | 31 | 11 | 42 | 28 % | 15% | 23 % |

| 49-40 | 10 | 5 | 15 | 9 % | 7 % | 8 % |

| 39-30 | 1 | 0 | 1 | 1 % | 0 % | 0.5 % |

| 29-0 | 0 | 0 | 0 | 0 % | 0 % | 0 % |

Note: * as of 1 July, 2020. Source: coronavirus2020.kz

Thus, as seen in Table 2, individuals aged 63+ for men and 59+ for females represent around 11 percent of the entire population in Kazakhstan on average. The highest proportions of elderly people are registered in Northern and Eastern oblasts (regions) of the country: North-Kazakhstan-18%, Kostanay-17%, East-Kazakhstan-17%, Pavlodar-15%, and Akmola-15%. Whereas, the smallest percentage of people older than 63+(59) are concentrated in Northern and Southern oblasts regions: Mangystau-7%, Turkestan-7%, Atyrau-8%, and Kyzyl-Orda-8%. These death and age distribution statistics suggest that general lockdown measures that keep the majority of citizens confined to their homes were motivated partly to shield the older part of the population, which primarily suppressed the spread of the coronavirus in general, across all age groups. Thus, another alternative lockdown strategy is to effectively address the isolation techniques of those 11 percent of older people, who are also most likely to experience health complications and will require special equipment in hospitals. In addition, administrative regulation of lockdown policies should be different in the North-Eastern and South-Western regions, where the proportion of older/younger people is different, such that the areas with higher proportion of aged individuals will go through stricter quarantine measures.

Table 2. Age-group distribution across regions in Kazakhstan (January 2020)

| Region | Total | 0-15 | 16-62 | 63+(59) | Share of 63+(59) |

| Kazakhstan | 18,631,779 | 5,636,761 | 10,874,656 | 2,1203,62 | 11% |

| Akmola | 736,735 | 186,927 | 442,158 | 107,650 | 15% |

| Aktobe | 881,651 | 268,474 | 522,184 | 90,993 | 10% |

| Almaty | 2,055,724 | 677,809 | 1,159,969 | 217,946 | 11% |

| Atyrau | 645,280 | 227,571 | 364,028 | 53,681 | 8% |

| West-Kazakhstan | 656,844 | 182,586 | 390,026 | 84,232 | 13% |

| Zhambyl | 1,130,099 | 399,884 | 618,759 | 111,456 | 10% |

| Karagandy | 1,376,882 | 347,006 | 825,820 | 204,056 | 15% |

| Kostanay | 868,549 | 186,332 | 538,489 | 143,728 | 17% |

| Kyzyl-Orda | 803,531 | 283,057 | 452,602 | 67,872 | 8% |

| Mangystau | 698,796 | 259,177 | 389,117 | 50,502 | 7% |

| Pavlodar | 752,169 | 182,016 | 454,768 | 115,385 | 15% |

| North-Kazakhstan | 548,755 | 121,546 | 326,461 | 100,748 | 18% |

| Turkestan | 2,016,037 | 799,717 | 1,068,281 | 148,039 | 7% |

| East-Kazakhstan | 1,369,597 | 333,409 | 808,322 | 227,866 | 17% |

| Nur-Sultan city | 1,136,156 | 351,925 | 694,254 | 89,977 | 8% |

| Almaty city | 1,916,822 | 463,505 | 1,226,014 | 227,303 | 12% |

| Shymkent city | 1,038,152 | 365,820 | 593,404 | 78,928 | 8% |

Source: Committee of Statistics, Ministry of National Economy of Kazakhstan

Economic consequences of COVID-19

The impact of the imposed lockdown on business operations to slow down the spread of the COVID-19 is not uniform to all sectors of the economy. Some industries are more exposed to the nature of the lockdown than others. Thus, for instance, those sectors of the economy that produce essential goods and services, such as food or communication technologies are less exposed to total quarantine measures since they can continue operating both in real and virtual realms. Additionally, the jobs in those sectors are more secure. Other types of industries, requiring non-essential production of goods and services and not fit for telework, such as retail stores, restaurants, hotels and construction which are more directly vulnerable to general shutdown policies and also face greater demand shortages in the future as people are likely to reduce their activities in high-physical contact trades, at least for a time being. According to the data from the Committee of Statistics, in 2019 the share of service sectors contributed for about 55.5 percent in the total value added in Kazakhstan, while the production of goods generated only around 37.5 percent of GDP (Nakipbekov 2020). Thus, the improvement of service sectors in the aggregate economy activity is immensely important.

At the same time, service sectors, informal employment, and small firms are at a greater risk of business failures and voluntary closures due to blanket lockdown policies. Informal jobs are often not covered by employment protection instruments, which among other things include firing restrictions and severance payments. Thus, informal jobs are much more flexible both in terms of separation and hiring decisions, and so they are likely to get destroyed first as soon as the shutdown hits, but also recover more rapidly than those in formal employment. In addition, the firm size determines the likelihood of the business’ survival and the jobs attached to those sectors. Hence, larger firms can rely on greater cash reserves and easier, cheaper credit lines, which can preserve employment for longer periods of time. On the other hand, smaller firms operate on much more limited reserves and frequently have a constrained access to emergency loans, such that it is harder for them to keep people employed.

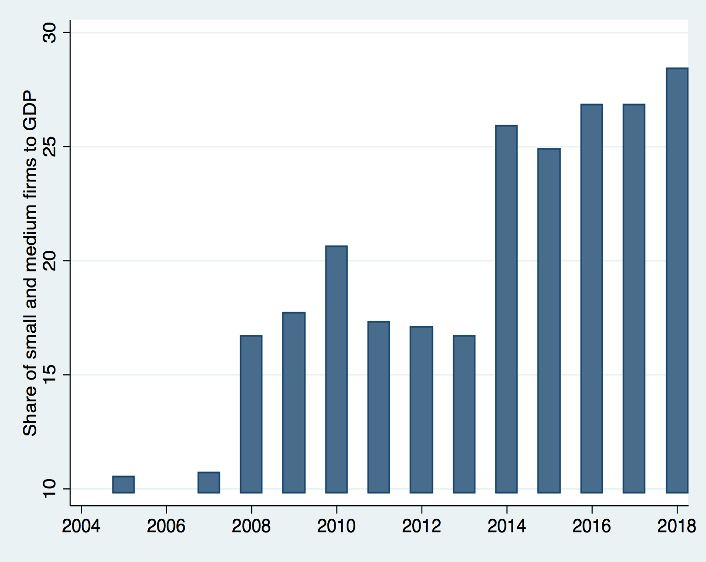

In the case of Kazakhstan, the share of small- and medium-size firms employment is significant, which means high economic risks for short-term destruction of jobs in these sectors. Figure 2 shows that for about the last five years, the share of small- and medium-size firms employment comprise about 40 percent out of total labor force. In addition, as seen in Figure 3 the value added in aggregate output (national GDP estimates) is also substantial. Recently, the share of small and medium firms has risen (2015-2018), and small and medium enterprises steadily contribute about 30 percent of Kazakhstan’s GDP. The aggregate statistics demonstrate that strict lockdown policies can seriously damage the economic activity, both in terms of income losses and jobs preservation schemes, which can start demand-induced business failures in the longer-term.

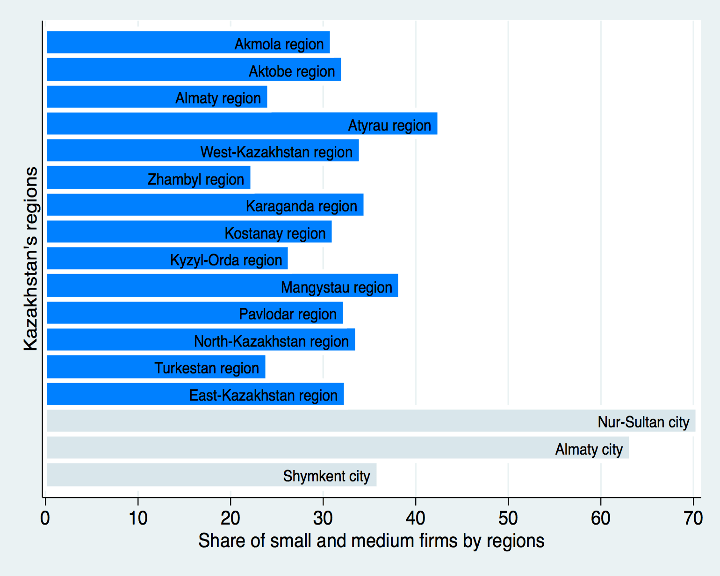

It is also important to analyze the regional distribution of small- and medium-size firms employment in Kazakhstan. Thus, as the Figure 4 reports, the average employment and lower bound of small and medium enterprises employment in all the regions is between 20 and 30 percent. In particular, the southern regions (Almaty oblast, Zhambyl oblast, Kyzylorda oblast, Turkistan oblast) exhibit a lower share of small-size firms’ employment on average than other regions. The natural resource-rich regions of West-Kazakhstan (Atyrau oblast, Mangystau oblast, and West-Kazakhstan oblast) employ about 40 percent of the entire regional workforce in small and medium enterprises. This can be explained by the prevalence of service sectors responding to a greater demand for the development of large mining industries. At the same time, a larger need for service sector employment might attract workers from the southern regions as well. Apart from regional disparities, the two largest outliers are the cities of Nur-Sultan and Almaty, which both account for more than 60 percent in small and medium business employment. Thus, we can conjecture that small-size firms’ employment is mostly concentrated in large cities and administrative centers of oblasts, and strict lockdown measures pose a potential risk of lost incomes and jobs for workers employed in these larger urban areas.

Figure 2. Share of small and medium size firms employment: 2006-2018*

Note: * As a percentage of total labor force. Source: Committee of Statistics, Ministry of National Economy of Kazakhstan

Figure 3. Share of small and medium firms value added in GDP: 2006-2018*

Source: Committee of Statistics, Ministry of National Economy of Kazakhstan

Figure 4. Regional distributional of small-and medium-size firms employment.*

Note: * Aggregate statistics for the year of 2018. Source: Committee of Statistics, Ministry of National Economy of Kazakhstan

Unemployment

With the launch of the state of emergency measures and subsequent general lockdown policy, the government shortly afterwards started to issue direct social payments, equal to one minimum monthly wage (42,500 tenge or about $100), to all those who lost jobs and sources of income due to the coronavirus pandemic (Ministry of Labor and Social Protection 2020). The majority of the population quickly responded to the call, massively applying online to the financial assistance. Since the state of emergency lasted two months, the Ministry of Labor and Social Protection has scheduled to transfer funds two times, for the months of March and April, to all those who applied in a timely manner. The scope of the program proved to be unprecedented, and in addition for obvious social aid purposes, this is used as an indicator to sketch out the depth of the economic downturn and estimate the relative magnitude of real-time unemployment caused by COVID-19 disruptions.

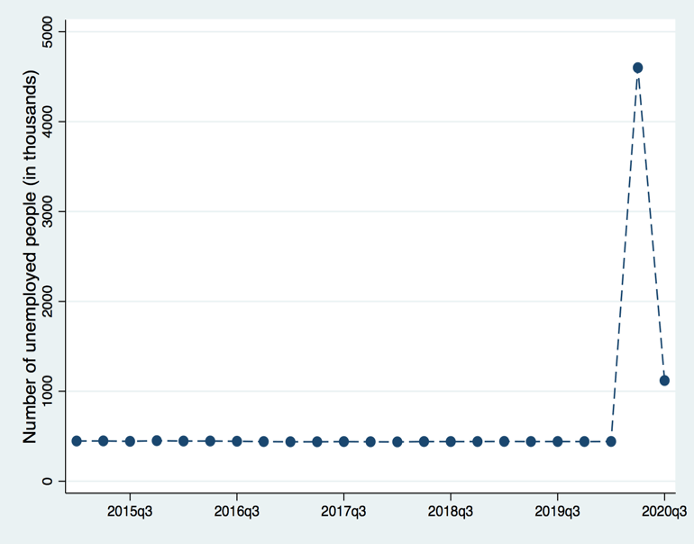

According to the data from the Ministry of Labor and Social Protection, 8 million people applied for social assistance (out of 9.2 million people in total labor force as of Q1 2020 as shown in Table 3). A total of 4.6 million people received the payments, with 2.9 million people collecting the payment in the second month as well. Therefore, it is possible to derive the hypothetical effects of the unemployment rate in Kazakhstan. Thus, as it is clear from Figure 5, for a significant period of time before the COVID-19 pandemic, the number of unemployed people fluctuated around 400,000-500,000 people quarterly, which corresponds to about 4.9 percent of the unemployment rate. We assume that those who applied for the direct social assistance program temporarily lost their jobs and were technically out of employment for the period of the lockdown. Hence, as the Ministry of Labor and Social Protection has later reported, after relaxing some strict lockdown measures on 20 April, 2020 (the state of emergency and blanket lockdown ended on 11 May, 2020) a considerable part of the population was able to return to work. Thus, according to the estimates from the Ministry of Labor and Social Protection, in the period of May-June 2020, there were approximately 1,140,000 unemployed people (Ministry of Labor and Social Protection 2020). The agency is forecasting a 6.1 percent unemployment rate by the end of the year, which is equivalent to about 700,000 people out of employment. Overall, 4.6 million people who received the social payment from the government during the lockdown (around 50 percent of total labor force) is nearly 10 times greater than the typical structural unemployment numbers of 450,000 people before the pandemic, which principally represents the sheer economic cost of the pandemic-induced supply shock. While the effect may rapidly be reversed to a degree, the economic scar is likely to have long-term depressing impacts on jobs and aggregate income in Kazakhstan.

Table 3. Total Labor Force in Kazakhstan (number of people 15+), 2015Q1-2020Q2

| 2017Q1 | 8,893,360 |

| 2017Q2 | 8,980,289 |

| 2017Q3 | 9,013,097 |

| 2017Q4 | 8,980,623 |

| 2018Q1 | 8,976,709 |

| 2018Q2 | 9,078,885 |

| 2018Q3 | 9,169,455 |

| 2018Q4 | 9,151,635 |

| 2019Q1 | 9,175,422 |

| 2019Q2 | 9,204,749 |

| 2019Q3 | 9,215,323 |

| 2019Q4 | 9,214,796 |

| 2020Q1 | 9,236,463 |

Source: Statistics Committee, Ministry of National Economy of Kazakhstan

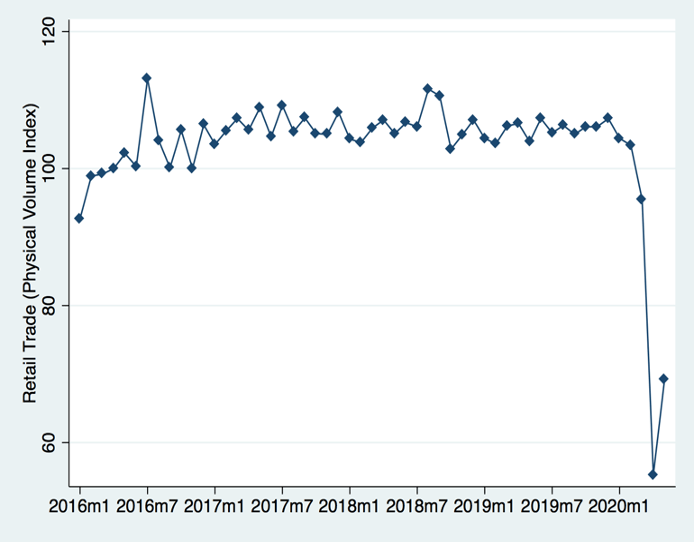

Another source of statistics on economic activity, which helps grasp the depth of the coronavirus-induced economic downturn, is the dynamics of the retail trade, measured by the physical volume index, presented in Figure 6. As we have mentioned earlier, the production of services accounts for about 55.5 percent of total value added in the country, so the impact on retail trade capacity bears a significant adverse impact on the overall potential economic output. In particular, the index first fell 7 percent in March of 2020, with a staggering 42 percent crash in the month of April. Nevertheless, the retail index rose by 25 percent in the following month of May, which simultaneously signaled the lowest point of the trade statistics. Again, the retail trade index dynamics illustrates that the effect of a strict lockdown contributed for around half of lost output (aggregate income) in a given period of 1.5 months, which is roughly identical to 8 percent of annual GDP. The economic consequences of such magnitudes imply that in the short-term people can consume less, which will cascade down on the negative ability of firms to recover and restart their businesses.

Figure 5. Unemployed Population in Kazakhstan, 2015Q1-2020Q2

Note: 2020Q2 is a projection of the Ministry of Labor and Social Protection. Source: Committee of Statistics, Ministry of National Economy of Kazakhstan

Figure 6. Retail Trade Index (Physical Volume), 2015m1-2020m5

Source: Committee of Statistics, Ministry of National Economy of Kazakhstan

Exchange Rate and Inflation

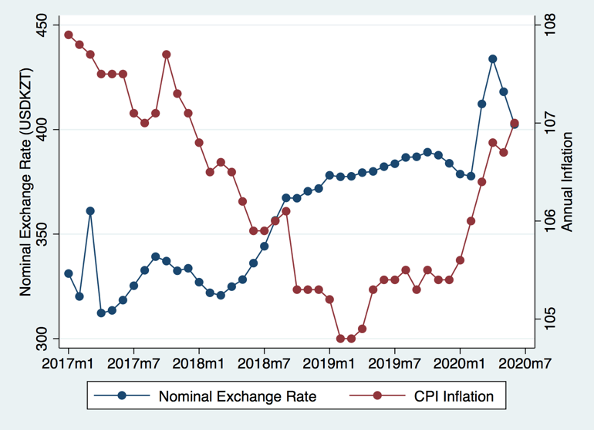

A set of major macroeconomic effects of the double-mixed oil and coronavirus shock has its impact on the exchange rate and inflation (Figure 7). The effect on the aggregate demand in Kazakhstan is typically transferred through the value of currency as a large share of the domestic consumption, and contains imported goods and services. Following the drop in oil prices, the domestic currency, tenge, initially depreciated rapidly, reaching 450 tenge to 1 USD at its lowest point in March 2020, which accounts for about a 20 percent decline from its previous average trend value. However, subsequently in the months of April and May, the national currency bounced back to the level of around 400 tenge per 1 USD and remained relatively stable around this newly elevated level. This level now represents about a 5 percent decrease in the international value of the national currency, and has some important implications for domestic prices.

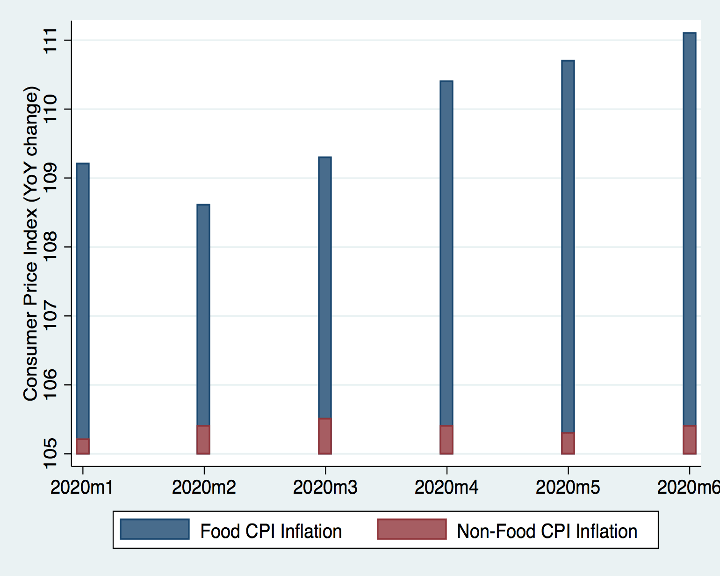

Inflation, a general increase in prices of goods and services, started to accelerate since the beginning of the pandemic, which by decreasing the purchasing power of wages will ultimately lead to a deterioration of economic well being for Kazakhstani citizens. Interestingly, as shown in Figure 8, within the headline of CPI inflation (consumer price index), there is a noticeable pattern of divergence between food and non-food inflation. Thus, since February 2020, food inflation increases sharply, leading to a maximum of 11.1 percent annual increase in June, while the non-food inflation raised only to a relatively modest extent of 5.4 percent. Thus, we can conjecture that the overall increase in domestic prices is primarily driven by food-inflation, a major spending item for low-to-middle income groups of population. The source of higher food-inflation might reflect both an increased excess demand for food products during the lockdown and a decrease in the value of the domestic currency as a substantial amount of food commodities is imported. Thus, to tackle the economic threat from the COVID-19 pandemic on rapid worsening of people’s economic conditions, the government’s fiscal response should also take into account accelerating food-inflation.

Figure 7. Nominal Exchange Rate and Inflation (YoY change), 2017m1-2020m5

Source: Statistics Committee, Ministry of National Economy of Kazakhstan

Figure 8. Food and Non-Food Inflation (YoY change), 2020m1-2020m6

Source: Statistics Committee, Ministry of National Economy of Kazakhstan

Kazakhstan’s government announced a relief package to help both businesses and workers emerge from the lockdown period, and reportedly designated around $13 billion dollars on pandemic response, which accounts for about 8 percent of GDP. On 25 June, 2020 the Asian Development Bank approved a $1 billion assistance package to help Kazakhstan mitigate the health, social, and economic impacts of the coronavirus pandemic. In particular, ADB is aiming to support a comprehensive COVID-19 health policy response, social protection and employment protection measures, and an economic stimulus plan introduced by the government to alleviate the adverse impacts of the pandemic (ADB 2020).

Due to the increased number of infections and deaths, on 29 June, 2020 the government adopted additional measures to mitigate the spread of COVID-19, which includes a significant improvement of mass testing capacities and an increase in domestic production of medical supplies. Also, Kazakhstan ultimately imposed a second national lockdown starting 5 July, 2020 until 2 August, 2020.

Conclusion

Since the writing of this paper, the pace of acceleration for the infection rate and the death toll is even more alarming and is forcing the government of Kazakhstan to place new measures of fighting the disease and its economic costs at the highest priority. The optimal response to the local development of the pandemic should be concentrated in immediate mobilization of resources to fund the medical system to save lives and to provide emergency loans for small and medium firms to avoid liquidation and then a cascade of bankruptcies. The provision of liquidity and credit at low-interest rate is also important to keep workers afloat and prevent a long-term depression of aggregate demand, which may have far more dire economic effects.

In this paper, we also showed that Covid19-induced negative supply shock and subsequent quarantine measures differentially affects the service sectors, driving productive activity in certain industries down to zero. Also, characterized by a higher share of informal employment and a greater absorption of small firms, service industries are at the greater risk of business failures and voluntary closures due to blanket lockdown policies. Thus, effective lockdown policies should be designed to aid the health sector with possibly a minimal exposure to general lockdowns. Well-designed policies include massive testing, tracing and isolation programs to ensure early mitigation of the spread of the virus. Such preventative measures, however costly they can initially appear, are negligible compared to the total costs of the blanket lockdowns.

Bibliography

Acemoglu, Daron, Victor Chernozhukov, Iván Werning, and Michael Whinston. “Optimal Targeted Lockdowns In a Multi-Group SIR Model.” NBER Working Paper 27102, 2020.

ADB. “ADB Approves $1 billion assistance package to support Kazakhstan’s pandemic response.” News Release, Asian Development Bank, 2020.

Alfaro, Laura, Andrew Charlton, and Fabio Kanczuk. “Plant-Size Distribution and Cross-Country Income Differences.” In NBER International Seminar on Macroeconomics 2008, by Jeffrey A. Frankel and Christopher Pissarides. Cambridge, MA: National Bureau of Economic Research, 2009.

Alfaro, Laura, Oscar Becerra, and Marcela Eslava. “EMEs and COVID-19 Shutting Down in a World of Informal and Tiny Firms.” NBER Working Paper 27360, 2020.

Allen, Danielle, Sharon Block, Joshua Cohen, Peter Eckersley, and Meredith Rosenthal. “Roadmap to Pandemic Resilience: Massive Scale Testing, Tracing, and Supported Isolation (TTSI) as the Path to Pandemic Resilience for a Free Society.” 2020.

Alon, Titan, Minki Kim, David Lagakos, and Mitchell VanVuren. “How Should Policy Responses to the COVID-19 Pandemic Differ In The Developing World?” NBER Working Paper 27273, 2020.

Alvarez, Fernando, David Argente, and Francesco Lippi. “A Simple Planning Problem for COVID-19 Lockdown.” NBER Working Paper 26981, 2020.

Atkeson, Andrew. “What Will Be the Economic Impact of COVID-19 in the US? Rough Estimates of Disease Scenarios.” NBER Working Paper 26867, 2020.

Bartik, A., M. Bertrand, Z. Cullen, E. Glaeser, M. Luca, and T. Stanton. “How are small businesses adjusting to COVID-19? Early evidence from a survey.” NBER Working Papers 26989., 2020.

Bento, Pedro, and Restuccia Diego. “On Average Establishment Size across Sectors and Countries.” Journal of Monetary Economics., 2020.

Cajner , T., L. Crane, A. Decker, A. Hamins-Puertolas, and C. Kurz. “Tracking labor market developments during the COVID-19 pandemic: A preliminary assessment.” Finance and Economics Discussion Series 2020-030, 2020.

Chetty, Raj, John Friedman, Nathaniel Hendren, and Michael Stepner. “How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data.” NBER Working Paper No. 27431, June 2020.

Coibion, O., Y. Gorodnichenko, and M. Weber. “Labor markets during the COVID-19 crisis: A preliminary view.” NBER Working Paper 27017, 2020.

Coronavirus2020.kz. March 13, 2020. Coronavirus2020.kz (accessed May 17, 2020).

Eichenbaum, Martin, Sergio Rebelo, and Mathias Trabandt. “The Macroeconomics of Epidemics.” NBER Working Paper 26882, 2020.

Eslava, M., J. Haltiwanger, and A. Pinzón. “Job Creation in Colombia vs the U.S.: ‘Up or out Dynamics’ Meets ‘The Life Cycle of Plants’.” NBER Working Paper 25550., 2019.

Hsieh, Chang-tai, and Peter Klenow. “Misallocation and Manufacturing TFP in China and India.” Quarterly Journal of Economics 124 (2009): 1403-1448.

Hsieh, Chang-tai, and Peter Klenow. “The Life Cycle of Plants in India and Mexico.” Quarterly Journal of Economics 129 (2014): 035-1084.

Humphries, J., C. Neilson, and G. Ulyssea. “The evolving impacts of COVID-19 on small businesses since the CARES act.” Cowles Foundation Discussion Paper No. 2230, April 2020.

Ministry of Labor and Social Protection. June 25, 2020. enbek.gov.kz (accessed June 27, 2020).

Naidoo, Karmen. The labour market challenges of COVID-19 in sub-Saharan Africa. June 10, 2020. https://www.africaportal.org/features/labour-market-challenges-COVID-19-pandemic-sub-saharan-africa/ (accessed June 17, 2020).

Nakipbekov, A. “Preliminary estimate of Kazakhstan’s GDP for the year 2019.” Committee of Statistics , Ministry of National Economy, 2020.

Poschke, Markus. “The Firm Size Distribution across Countries and Skill-Biased Change in Entrepreneurial Technology.” American Economic Journal: Macroeconomics 10, no. 3 (2018): 1-41.

Romer, Paul . “Roadmap to Responsibly Reopen America.” roadmap.paulromer.net, 2020.

Rowthorn, Robert, and Flavio Toxvaerd. “The Optimal Control of Infectious Diseases via Prevention and Treatment.” Technical Report 2013, Cambridge-INET Working Paper, 2020.

Stock, James. “Data Gaps and the Policy Response to the Novel Coronavirus.” Working Paper 26902, 2020.

Tybout , James. “Manufacturing Firms in Developing Countries: How Well Do They Do, And Why?” Journal of Economic Literature 38, no. 1 (2000): 11-44.