An Economic and Financial Impact Analysis

Waris Ahmad Faizi is currently an Erasmus+ exchange student at Otto von Guericke University Magdeburg (OVGU) in Germany, where he is pursuing an MA in Peace and Conflict Studies. Prior to this, he worked as a senior economic and development specialist for the Capital Region Development Authority in Kabul, Afghanistan. He has also worked at Pearl Horizon Consultancy as an economic consultant and research specialist, focused on World Bank Group research and development projects in Afghanistan. Additionally, he served as a visiting lecturer in business and economics for 5 years in some of the best-ranked universities in Kabul. He holds an MA in Economic Governance and Development from the Organization for Security and Cooperation in Europe (OSCE) Academy (2020), and a joint MBA from Ball State University (Indiana, USA) and Kabul University (2017).

Trade ties between Central Asia and South Asia date back centuries. People and goods have flowed through the areas for millennia, creating cultural and religious linkages that have had a direct influence on their political relations. The current and future economic growth and development of nations in Central and South Asia depend heavily on trade, investment, and economic collaboration between the two regions (Lord 2015). In recent years, energy connectivity to link Central Asia’s abundant energy resources with South Asia’s major energy markets has been a high priority on the international agenda. Among these countries, two projects are already underway: the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline and the Central Asia–South Asia (CASA-1000) energy project (Iqbal 2018).

The Central Asia-South Asia (CASA-1000) power transmission project is a 1,227-kilometer cross-border transmission line that has begun construction in Central Asia and South Asia. The CASA-1000 power transmission system is a modern and efficient infrastructure project that will help modernize the area and mark a significant step toward the projected Central Asia-South Asia Regional Electricity Market (CASAREM). The project’s goal is to develop a trade in electricity production in which excess hydropower in Central Asia is transferred to electricity-deficient nations in South Asia. Under the initiative, surplus electricity from Kyrgyzstan and Tajikistan would be exported to Afghanistan and Pakistan. Due to the consequences of the coronavirus pandemic, the CASA-1000 electricity transmission project between Kyrgyzstan, Tajikistan, Afghanistan, and Pakistan has been temporarily suspended. The literature consulted for the study represents theoretical research pieces.

The CASA-1000 electrical transmission and trade project, worth $1.2 billion, will connect the power networks of four Central/South Asian countries (Kyrgyzstan, Tajikistan, Afghanistan, and Pakistan) and establish international-standard power trading procedures. The project entails the upgrading of the required power grid complex, the building of new substations, and the installation of a high-voltage transmission line that will allow Kyrgyzstan and Tajikistan to export electricity to Pakistan and Afghanistan during the summer (CIS Electric Power Council, 2021). If CASA-1000 is implemented, it will be a milestone in the region’s energy industry, allowing Afghanistan to establish itself as a transit nation between Central Asia and South Asia. The project may enhance the economies of all participating states by allowing for the importation of inexpensive electric power and ensuring supply security for importing countries, as well as profits from the sale of electricity to new purchasers and transit fees for exporting and transit countries (Marty 2015).

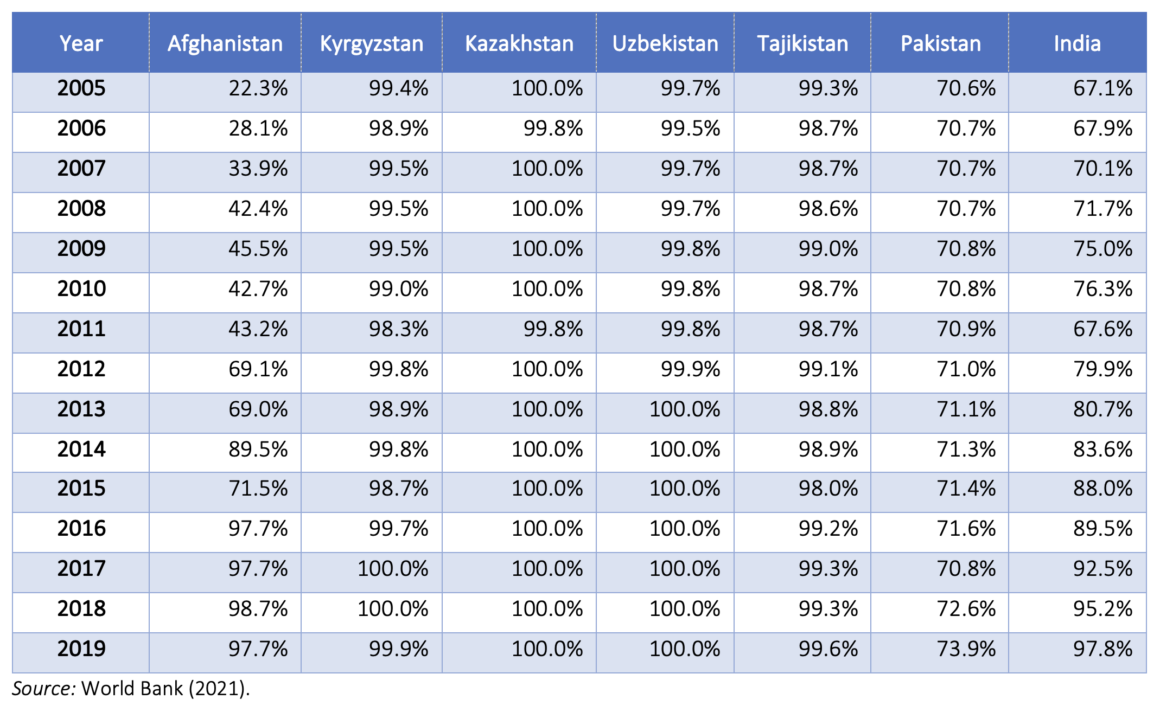

What follows are some statistics and time-series data on the electrical situation in Central and South Asian nations. Figure 1 and Table 1 indicate the percentage of the population who had access to electricity in South Asian and Central Asian countries from 2005 through 2019. These show that the whole populations of the Central Asian nations (Kyrgyzstan, Uzbekistan, Tajikistan, and Kazakhstan) had access to electricity between 2005 and 2019. During that same time, the number of people in the South Asian nations of India and Afghanistan with access to electricity increased, while access to electricity (as a percentage of the population) in Pakistan merely remained flat.

FIGURE 1. Access to electricity (% of population)

Source: World Bank (2021). Note: The gray line representing Kazakhstan is obscured because it mirrors those for its neighbors Kyrgyzstan, Uzbekistan, and Tajikistan.

TABLE 1. Access to electricity (% of the population)

Likewise, Figure 2 illustrates the electrical power consumption in Central Asian and South Asian countries from the years 2005 through 2014. The graph demonstrates that electrical power consumption per capita among the Central Asian and South Asian countries is by far the highest in Kazakhstan, with its fellow Central Asian nations Tajikistan, Uzbekistan, and Kyrgyzstan clustering together at much lower levels, and with Pakistan and India even lower than these.

FIGURE 2. Electricity consumption (kWh per capita)

Source: IEA (2021).

Figure 3 indicates the time required to get electricity in Central Asian and South Asian countries from 2013 through 2019. The graph shows that for this period, the time (number of days) necessary to get access to power in Central Asian nations (Kazakhstan, Kyrgyzstan, Uzbekistan, and Tajikistan) was shorter than in a couple of the South Asian countries (that is, in Afghanistan and Pakistan, though in more recent years, not so in India, which surged ahead to become the fastest at providing access). In Pakistan in particular, a longer period to get access to electricity was required than in any of the other nations listed until 2019. Hence, the time necessary to get access to power is one of the other main indicators that displays Central Asia’s relative dominance over its Afghan and Pakistani neighbors. Taking into account the aforementioned facts and figures from the Central Asian and South Asian countries, South Asia has a strong need for electricity, while Central Asia has an abundance of electricity. Hence, it would be a win-win strategy for both regions to engage in trade.

FIGURE 3. Time required to get electricity (days)

Source: World Bank (2021).

Research Objectives/Questions

The purpose of this research is to assess the potential effects of the CASA-1000 megaproject considering its pre-suspension and post-suspension scenarios. In doing so, the current study has undertaken a quantitative approach to the CASA-1000 project’s expected economic and financial impacts, for both the periods before (what was planned) and after (what is currently going on) the coronavirus pandemic. The study will also focus on an analysis of the future economic prospects of the CASA-1000 project, given the current political situation in Afghanistan following the Taliban takeover in August 2021. Moreover, the research intends to contribute to the economic literature in both academic and professional fields. Furthermore, the findings and results of this study will enable others in Central Asia and South Asia to research similar topics for future studies. Thus, the study seeks to provide answers to the following research questions:

- How have the economic and financial implications of the CASA-1000 project been altered from what was originally planned?

- To what extent is the CASA-1000 megaproject commercially and financially viable and feasible in light of Afghanistan’s recent regime change?

H0 (Null Hypothesis): The economic and financial potential of the CASA-1000 power project has not been reduced as a result of the regime change and project implementation delay.

Ha (Alternative Hypothesis): The economic and financial potential of the CASA-1000 power project has been reduced as a result of the regime change and project implementation delay.

Literature Review

There have been very few studies on the influence of the CASA-1000 electrical project on the potential for economic growth in Afghanistan, South Asia, and Central Asia. The author attempted to find and examine the most crucial pieces of literature on the topic. Furthermore, the literature’s works represent both theoretical and empirical research pieces. What follows is a breakdown of how the author conducted both theoretical and empirical literature reviews.

During the summers, power is abundant in certain Central Asian nations. In Kyrgyzstan and Tajikistan, clean hydropower resources are plentiful. In South Asia, on the other hand, Afghanistan and Pakistan have large and expanding business and household power demand and consumption. The new high-voltage power transmission line CASA-1000, which is designed to connect these four nations in Central and South Asia, would help decrease energy shortages and promote economic development by enabling electricity trading between these countries. International funders and financial organizations have lent their assistance to the CASA-1000 building project. Investing in the CASA-1000 project is a key first step in enhancing regional energy cooperation and opening up new markets for cross-border power trading. Since 2014, USAID has funded and supported the Inter-Governmental Council CASA-1000 Secretariat. The CASA-1000 Secretariat plays a key role in enabling and speeding up the completion of this enormous international infrastructure project. To encourage regional power trading, the Secretariat also assists in the establishment of commercial and institutional frameworks for the purpose. USAID has further contributed to a donor trust fund to assist with the project’s financing. As part of the 1,300-kilometer CASA-1000 project, South Asia’s expanding need for energy will be met by the 1,300 megawatts (MW) of clean hydropower resources of Central Asia when it is completed, hence promoting trade and autonomy in the region (USAID 2021).

The following are some of the most recent actions related to the advancement of the project:

- In Kyrgyzstan, 97 transmission towers have been erected for transmission lines. The Kyrgyz Republic will require 1,241 towers to be erected in total.

- Civil construction on Tajikistan’s crucial Sangtuda high-voltage direct current (HVDC) converter station has reached more than 90% completion, with overall construction standing at more than 70% completion (USAID 2021).

- In Afghanistan, transmission tower development has continued, with excavations for 680 transmission towers finished and 164 towers constructed.

- Assistance has been offered in finalizing the HVDC Technical Code, which is essential for commercial operations in order to synchronize the grid codes of each CASA-1000 country for power trade and exchange.

- All private land compensation payments have been finalized at the Nowshera Converter Station site in Pakistan, and construction has begun (USAID 2021).

Ismailov et al. (2021) indicate that the CASA-1000 project has been temporarily halted due to the effects of the coronavirus pandemic. Even if the pre-suspension plan for project completion by 2023 had been plausible, once the investment is finally ready to go ahead, the Taliban will have to provide security assurances in this regard. As part of the CASA-1000 project, Tajikistan aims to provide Pakistan through Afghanistan with 1,300 MW of electricity. In addition, Tajikistan plans to export 75 billion kWh of power through CASA-1000 over the course of 15 years. As of now, just 30% of the CASA-1000 construction on the Afghan portion of the transmission project has been completed, which does not meet the optimistic goal of completing the Afghan segment by 2023 (Ismailov et al. 2021). Neighboring countries like Turkmenistan, Uzbekistan, Tajikistan, and Iran will quickly review the chances of success for investment projects that rely on Afghanistan’s assistance and collaboration in light of the country’s return to Taliban control after 20 years (Ismailov et al. 2021).

Powers (2021) argues that Tajikistan is the only country in Central Asia that is openly opposed to the Taliban regime in Afghanistan. Until the Taliban administration includes Tajik and minority representation in the government and guarantees full political power for ethnic Tajiks living in Afghanistan, the government of Tajikistan will refuse to recognize the regime. Tajikistan has a great interest in Afghanistan’s ethnic Tajik minority of around 8 million, which makes up around a quarter of the country’s population. As the security situation in Afghanistan deteriorates, drug and gun trafficking will increase, as well as organized crime. Tajikistan’s efforts to fight these problems would be jeopardized if this were to happen. Additionally, vital infrastructure projects are in danger in the area, which puts the whole region at risk. In order to complete the Turkmenistan, Afghanistan, and Tajikistan (TAT) Railway System and the CASA-1000 energy projects, governments in the area need to be stable and cooperative (Powers 2021).

Research Design and Methodology

Different authors have used different estimations and methodologies based on the nature of their data and model specifications. Considering the literature review conducted and the availability of data and resources for the present research, a quantitative approach has been applied. For quantitative analysis, a comparative analysis of the CASA-1000 project’s financial and economic feasibility according to what was planned and what the situation is now (under the current Taliban regime) has been conducted. For doing so, a cash-flow analysis has been conducted. Furthermore, the most significant economic and financial indicators, which are essential to a project’s investment feasibility, have been measured. Likewise, for comparison purposes, the project’s pre-suspension period is referred to as Scenario A, while the present project state is referred to as Scenario B. What follows are the findings and outcomes of the analysis.

The study’s main limitation and constraint was the absence of a number of Afghan potential experts on the CASA-1000 project with whom to conduct interviews. Because of Afghanistan’s ongoing regime shift, the majority of them have either migrated or could not be located. Likewise, international organizations and agencies have not provided any updates on the CASA-1000 project in recent months. Hence, conducting interviews and collecting qualitative data was not an option.

Findings and Results

For this study, a quantitative research method used was to anticipate CASA-1000’s future in the context of Afghanistan’s new government. A comparative analysis of the economic and financial viability of the CASA-1000 project was conducted to compare the data between what was expected and what the reality of the project currently looks like. In doing so, the study was carried out as a comparative analysis of the two scenarios, hence assisting in determining the future of the CASA-1000 project in the context of the new Afghanistan. The findings and results are as follows.

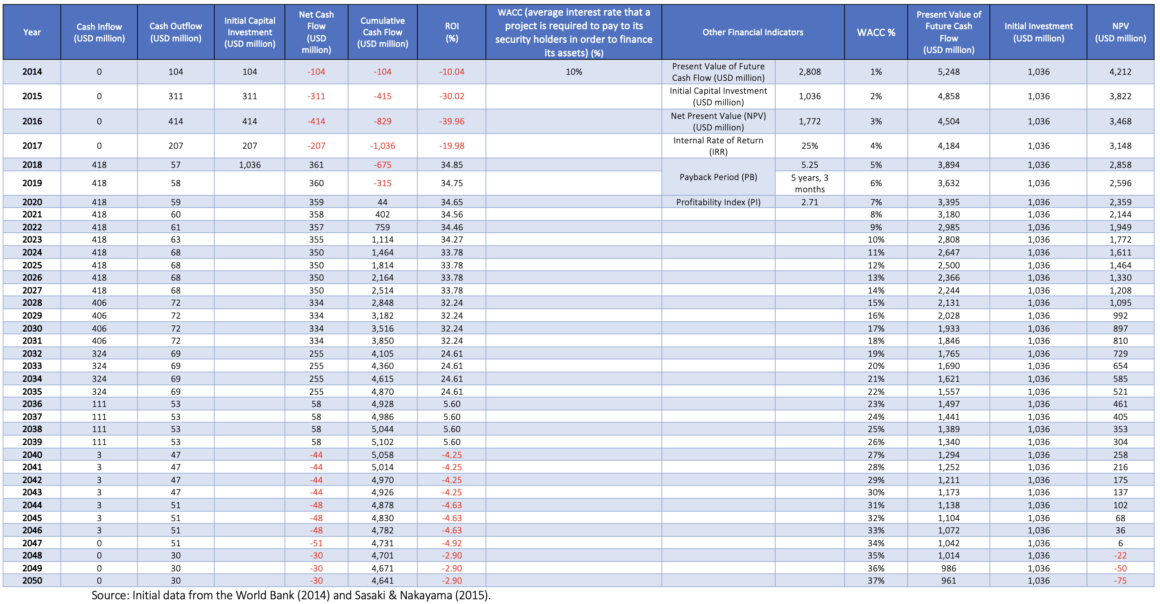

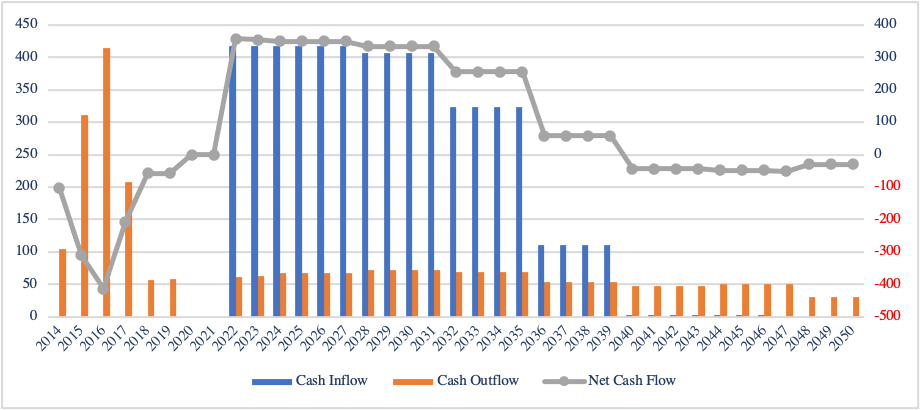

Table 2 and Figure 4 show that, according to what was planned for the CASA-1000 project’s execution, its initial capital investment was US $1.036 billion, with the project expected to be completed over four years, from 2014 through 2017. The cash inflow was anticipated to begin in 2018. During the development phase, the project’s net cash flow (net profit) was negative for the first four years, while immediately after its completion, net cash flow was expected to reach a positive value of US $361 million in 2018, and to stay constant and positive through 2031, after which time, according to projections, the data shows it dropping down and plateauing three times between 2032 and 2040.

With a 10% weighted average cost of capital (WACC), the net present value (NPV) is US $1.772 billion, and the internal rate of return (IRR) is 25%, demonstrating the project’s economic and financial viability. Its payback period (PB) is 5 years and 3 months, showing the time it will take to recoup the cost of the capital expenditure, or the time required for the project investment to reach a breakeven point. Considering the project’s vast magnitude, the PB is short, indicating that the project is a good investment. Furthermore, its profitability index (PI) is 2.71, reflecting the amount of value generated per unit of investment, which is more than double. This indicates that for every dollar spent on the project, the payout will be $2.71, demonstrating the desirability of the investment.

TABLE 2. CASA-1000 Project economic and financial feasibility analysis—as per what was planned (Scenario A)

FIGURE 4. Cash inflow, cash outflow, and net cash flow—as per what was planned (Scenario A)

Source: Initial data from the World Bank (2014) and Sasaki & Nakayama (2015). Note: The left-hand axis values represent USD in millions relative to the bar-graph values (cash inflow and cash outflow); the right-hand axis values represent USD in millions relative to the line-graph values (net cash flow).

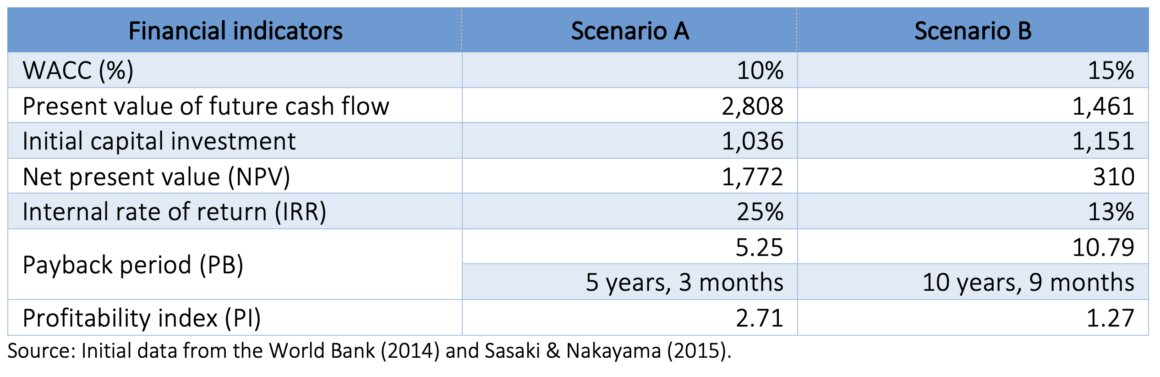

Table 3 and Figure 5 show that, based on the past two years and the present circumstances, the project’s initial capital investment was US $1.151 billion, with the project originally expected to be finished in six years, by 2021. If the cash inflow began in 2022, for the first four years (during the project’s development), the net cash flow (net profit) was to be negative. For the next two years, there was to be no net cash flow at all, while immediately after the completion of the project, the net cash flow was projected to be positive in 2022 and to remain steady and positive through 2039.

Given the ongoing uncertainty, instability, and regime transition in Afghanistan, the project’s weighted average cost of capital (WACC) is expected to be 15%. Taking into consideration this 15% WACC, the NPV would be US $310 million, and the IRR would be 13%, both of which are significantly lower. Furthermore, the project’s payback period (PB) is now estimated to be 10 years and 9 months, showing the greatly increased time it will take to recoup the cost of the capital expenditure, or the time required for the project investment to reach a breakeven point. The PB is now more than double its initial projection, which reduces the project’s investment potential to some degree. Furthermore, the project’s profitability index (PI) is 1.27, meaning that the amount of value generated per unit of investment is still greater than one. This indicates that for every dollar spent on the project, the payout will be $1.27, demonstrating the investment’s continuing profitability.

TABLE 3. CASA-1000 Project economic and financial feasibility analysis considering the current situation (Scenario B)

FIGURE 5. Cash inflow, cash outflow, and net cash flow, in millions of US dollars – as per the current situation (Scenario B)

Source: Initial data from the World Bank (2014) and Sasaki & Nakayama (2015). Note: The left-hand axis values represent USD in millions relative to the bar-graph values (cash inflow and cash outflow); the right-hand axis values represent USD in millions relative to the line-graph values (net cash flow).

Table 4 demonstrates a comparative analysis of the CASA-1000 project’s economic and financial feasibility indicators between what was planned (Scenario A) and the current situation (Scenario B). It further demonstrates that the present value of future cash flow in Scenario A will be double that of Scenario B. Similarly, the needed initial capital expenditure in Scenario A is lower than in Scenario B due to the project’s delay as well as the change in the time value of money. What is significant is the large difference in NPV and IRR between the two scenarios, indicating how much the investment’s feasibility has fallen. Similarly, the more than doubling in the payback period and profitability index between the scenarios implies how much the level of attractiveness and interest in the CASA-1000 project has decreased due to political instability, project delays, and the recent regime change in Afghanistan. However, since the NPV is still positive and the IRR is 13% in Scenario B, the investment in the project is still regarded as worthwhile.

TABLE 4. Comparative analysis of CASA-1000 project’s economic and financial feasibility between what was planned (Scenario A) and the current situation (Scenario B)

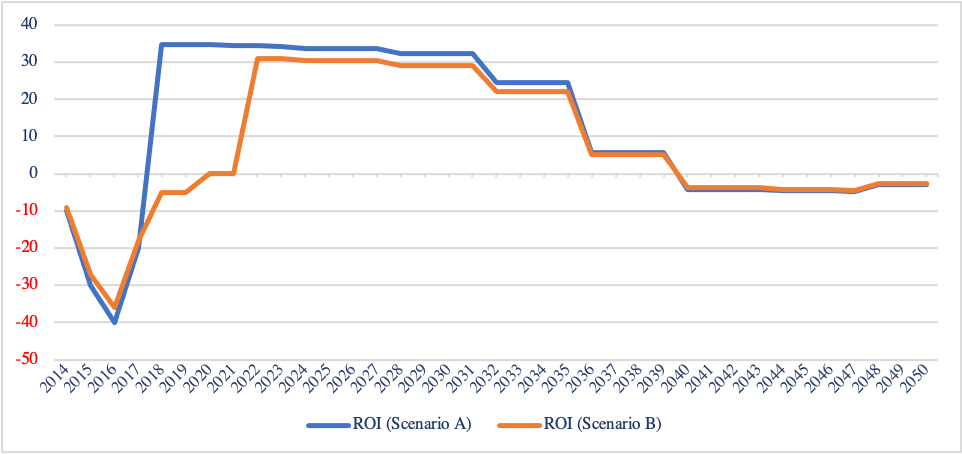

Furthermore, Figures 6 and 7 provide a comparative analysis of the CASA-1000 project’s net cash flow and return on investment (ROI) between the two scenarios, respectively. These indicate an excess of net cash flow and return on investment (ROI)[1] for Scenario A over those seen under Scenario B. However, the differences are not that significant.

FIGURE 6. Comparative analysis of CASA-1000 project net cash flow, in millions of US dollars, between what was planned (Scenario A) and the current situation (Scenario B)

Source: Initial data from the World Bank (2014) and Sasaki & Nakayama (2015).

FIGURE 7. Comparative analysis of CASA-1000 project’s ROI, in millions of US dollars, between what was planned (Scenario A) and the current situation (Scenario B)

Source: Initial data from the World Bank (2014) and Sasaki & Nakayama (2015).

Conclusion

It has been concluded that, as a result of regime change in Afghanistan and the project delays, the CASA-1000 project’s economic and financial benefits have been affected negatively. When the project’s investment is taken into account, the economic and financial feasibility of the present scenario is less than half of what was planned for. The consequences will be far more severe if the project is not resumed promptly. Hence, CASA-1000’s future depends on countries in the region and the international community’s decisions on whether to accept Afghanistan’s new regime, especially to the extent that these decisions bear on the authorities of international organizations that were funding the project. Furthermore, developing better regional integration between Afghanistan and Central and South Asia is essential for both sides in order to manage the project properly. Future development of the project, on the other hand, is more dependent on its operational safety than on agreed-upon details, implying that its viability is linked to overall improvements in Afghanistan and Pakistan’s security situations, as well as their political and economic relationships.

Bibliography

- https://sites.google.com/site/iceafghanistan/regional-projects-and-masterplanning—overview/casa-1000.

- https://tolonews.com/business/afghanistan-begins-work-casa-1000-power-project.

- https://policy.asiapacificenergy.org/node/2345.

- http://www.casa-1000.org/newsandevents-2/.

- https://thediplomat.com/2018/02/casa-1000-creeps-toward-construction-bridging-central-and-south-asia/.

- https://www.cesi.it/projects/operating-strategy-for-casa-1000-project/.

- http://energo-cis.ru/ennews/the_largest_energy_p1615787088/.

- 2019. Central Asia South Asia Electricity Transmission and Trade Project (CASA- 1000). June 11, 2019. https://main.dabs.af/Reports/ReportDetail/75.

- https://www.energy.gov/eere/eere-initiatives-and-projects.

- https://www.gica.global/initiative/casa-1000.

- https://www.hitachienergy.com/references/hvdc/casa-1000.

- https://www.hydrocarbons-technology.com/projects/turkmenistan-afghanistan-pakistan-india-tapi-gas-pipeline-project/.

- https://www.iea.org/data-and-statistics/data-browser/?country=WORLD&fuel=Energy%20consumption&indicator=CO2Industry.

- https://criterion-quarterly.com/political-perspective-south-asia-central-asia-connectivity/.

- https://www.irena.org/Statistics.

- https://intellinews.com/as-taliban-regime-takes-shape-central-asia-and-iran-assess-fate-of-afghanistan-investments-218257/.

- https://24.kg/english/188742_CASA-1000_Construction_of_high_voltage_power_transmission_tower_starts/.

- https://mpra.ub.uni-muenchen.de/66436/1/MPRA_paper_66436.pdf.

- https://www.cacianalyst.org/publications/analytical-articles/item/13152-casa-1000-–-high-voltage-in-central-asia.html

- . 2021. “Central Asia–South Asia (CASA-1000) Electricity Transmission Project.” Accessed December 1, 2021. https://www.nsenergybusiness.com/projects/casa-1000-electricity-transmission/.

- https://www.caspianpolicy.org/research/security-and-politics-program-spp/unlike-its-neighbors-tajikistan-refuses-to-engage-with-the-taliban-and-bolsters-security.

- https://www.usaid.gov/central-asia-regional/fact-sheets/secretariat-casa-1000-power-transmission.

- https://projects.worldbank.org/en/projects-operations/project-detail/P145054.

- https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS